Stamp Duty and Registration Charges on Real Estate Transactions in New Okhla Industrial Development Authority (Noida)

Stamp duties are governed by the Indian Stamp Act, 1899 as well as by the respective Stamp Acts of the State Governments. While on a certain specified Instruments, the Central Government has power to impose Stamp duty, on other instruments, which include sale deed, the respective State Governments can levy the stamp duty. Thus, a State legislature can fix the stamp duty on instruments like

-

- Sale Deed

- Gift Deed

- Lease Deed

- Partition Deed

- Settlement Deed

- Mortgage

- Affidavit

- License etc

STAMP DUTY IN NOIDA ON SALE/PURCHASE OF PROPERTY TRANSACTIONS

As per Section 17 of The Registration Act, 1908, as applicable to Uttar Pradesh, any transaction, as mentioned in the Act, of an immoveable property of the value of above Rs.100/- is required to registered. For such registration, the applicable Stamp Duty and Registration charges are needed to be paid. In view of this, in any sale/purchase transaction of a property in NOIDA, the buyer of the property has to bear stamp duty/registration charges. In the case of a conveyance deed, the stamp duty is chargeable on the property value arrived at based on circle rate or the agreed sale value, whichever is higher

Rates of Stamp Duty in NOIDA

In the case of NOIDA, which is a city in the State of Uttar Pradesh, the following are the Stamp Duty Rates, in the case of sale/purchase of a Property, as per The Indian Stamp Act, 1899 (As amended in its application to Uttar Pradesh) along with the Charges to be paid for Registration:

| Gender | Rate of Stamp Duty | Charges for Registration |

| Man | 5% of the value of property | 1% of the value of property |

| woman | 5% of the value of property minus Rs.10,000/- | 1% of the value of property |

| Joint (Man + Woman) | 5% of the value of property. | 1% of the value of property |

| Joint (Man +Man) | 5% of the value of property | 1% of the value of property |

| Joint (Woman + Woman) | 5% of the value of property minus Rs.10,000/- | 1% of the value of property |

STAMP DUTY RATE ON GIFT DEED IN NOIDA

As per the ruling of the Hon. High Court of Allahabad, the stamp duty on a gift deed can be levied only based on the value of the property and not on its market value. In Uttar Pradesh, Stamp Duty is charged @ 2% on a Gift Deed. However, transfer of a property between blood relatives can be done by paying a stamp duty of Rs 5,000/-. For this purpose, following relatives are covered:

- Father

- mother

- husband

- wife

- son

- daughter

- daughter in law (wife of son)

- son in law (husband of daughter)

- real brother

- real sister

- Grand son/grand daughter

Stamp Duty on other documents related to Real Estate Transactions

Name of the document |

Stamp duty Rate/ Rupees, as the case may be |

| Affidavit | Rs. 10 |

| Agreement | Rs 10 |

| Bond | Rs. 200 |

| Exchange deed | 3 per cent |

| Lease deed | Rs 200 |

| Power of Attorney (General) | Rs 10 to Rs.100 |

| Power of Attorney(Special) | Rs 100 |

| Notary | Rs 10 |

| Will | Rs 200 |

VALUATION OF THE PROPERTY FOR THE PURPOSE OF CALCULATION OF STAMP DUTY TO BE PAID IN NOIDA

In NOIDA, Sale/Purchase of Property in NOIDA is done on the basis of Carpet Area.

Order dated 6.12.2023 of RERA U.P. regarding Carpet Area

Uttar Pradesh Real Estate Regulatory Authority vide its Office order 6.12.2023, while reiterating the provisions of Section 2(k) of the The Real Estate (Regulation And Development) Act, 2016, clarified that sale and purchase of property in Uttar Pradesh shall be on the basis of Carpet area and any sale and purchase on the basis of super area shall be considered as illegal.

As per the above mentioned Section, Carpet Area is the net usable floor area of an apartment. However following are exclusions and inclusion:

Exclusions

-

- the area comprised in the external walls,

- areas under services shafts,

- exclusive balcony or verandah area and

- exclusive open terrace area,

Inclusion

the area comprised in internal partition walls of the apartment.

Thus, Carpet Area shall be the basis for sale and purchase of the property in NOIDA

Circle Rate

A Circle Rate, which is fixed by the State Government is the lowest or the minimum price at which a property has to be registered that state in case of its transfer by way of a sale or a gift. Thus, the circle rate in a Uttar Pradesh is a benchmark below which transaction of property cannot be legally registered in NOIDA, being a city in Uttar Pradesh.

CALCULATION OF STAMP DUTY IN NOIDA

Stamp Duty is charged on the valuation of property arrived at by using the circle rate or market value i.e. sale price at which transaction is done, which ever is higher,

Example 1

Where actual sale price is higher than the value arrived at as per circle rate

Let us say there is a property, the carpet area of which is 900 Sq.ft. and the circle rate of that property is 7000 per sq ft. The Property value in such a case will be calculated as follows:

Carpet area: ₹900 sq. ft.

Circle rate: ₹7000 per sq. ft.

Value of the Property as per circle rate will be = 900 x 7000 = Rupees 63,00,000/-

The Sales Price of the Property is : Rupees 70,00,000/- (Rupees Seventy Lakh)

As the Sales Price is more than the valuation of the property as per carpet area rate, Stamp duty will be charged on Rs. 70,00,000/- (Rupees Seventy Lakh) In this case, following amounts will have to be paid:

- Man

Rs.70,00,000 X 5% = Rs. 3,50,000/- (Rupees Three Lakh Fifty Thousand)

- Woman

Rs.70,00,000 X 5% = Rs. 3,50,000/- minus Rs.10,000/- = Rs.3,40,000/- (Rupees Three Lakh Forty Thousand)

- Joint (Man and Woman)

Rs.70,00,000 X 5% = Rs. 3,50,000/- = Rs.3,50,000/- (Rupees Three Lakh Fifty Thousand)

- Joint (Woman and Woman)

Rs.70,00,000 X 5% = Rs. 3,50,000/- minus Rs.10,000/- = Rs.3,40,000 (Rupees hree Lakh Forty Thousand)

Example 2

Where actual sale price is lower than the value as per circle rate

Let us say there is a property, the carpet area of which is 900 Sq.ft. and the circle rate of that property is 7000 per sq ft. The Property value in such a case will be calculated as follows:

Carpet area: ₹900 sq. ft.

Circle rate: ₹7000 per sq. ft.

Value of the Property as per circle rate will be = 900 x 7000 = Rupees 63,00,000/- (Rupees Sixty Three Lakh)

The Sales Price of the Property is : Rupees 60,00,000/-(Rupees Sixty Lakh)

As the Sales Price is lower than the valuation of the property as per carpet area rate, Stamp duty will be charged on Rs. 63,00,000/- (Rupees Sixty Three Lakh)

- Man

Rs.63,00,000 X 5% = Rs. 3,15,000/- (Rupees Three Lakh Fifteen Thousand)

- Woman

Rs.63,00,000 X 5% = Rs. 3,15,,000/- minus Rs.10,000/- = Rs. 3,05,000/-(Rupees Three Lakh Five Thousand)

- Joint (Man and Woman)

Rs.63,00,000 X 5% = Rs. 3,15,000/- (Rupees Three Lakh Fifteen Thousand)

- Joint (Woman and Woman)

Rs.63,00,000 X 5% = Rs. 3,15,,000/- minus Rs.10,000/- = Rs. 3,05,000/-(Rupees Three Lakh Five Thousand)

PAYMENT OF STAMP DUTY ONLINE IN NOIDA

For online payment of stamp duty in Noida, one has to follow the following steps:

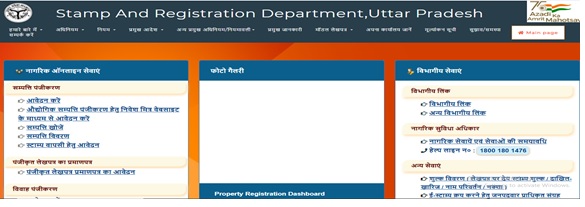

Step 1. individuals have to go to the official portal of the Stamp and Registration Department UP.Visit the official Portal of the Stamp and Registration Department, Uttar Pradesh (IGRSUP portal) and login at https://igrsup.gov.in/igrsup/defaultAction. The following page will appear:

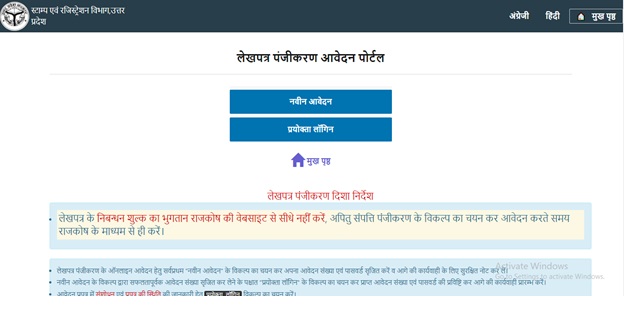

Step 2: On reaching the above homepage, select “Aavedan Karein” (Apply for) option under the “Sampatti Panjilaran” (Property Registration), the following page will open:

Step 3 : Select option of “Naveen Aavedan” (New Registration) in “Lekhpatra Panjikaran Application Portal” (Property Registration Application Portal} when following page will appear:

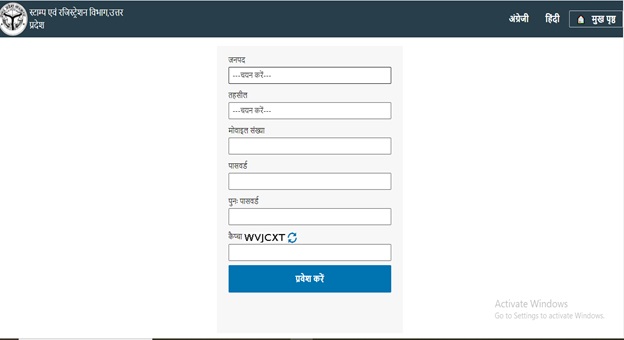

Step 4 Enter the following details: “Janpad”(District), “tehsil” (Tehsil), “mobile sankhya”(Mobile Number), “password” (Password(, “punah password” (Re-Password), “captcha” (Captcha) and click “Pravesh Karein” (Sign in).

Step 5: One will be directed to a form, wherein required property and other will have to be entered and asked for will have to be uploaded.

Step 6 On submission of the Form, stamp duty will be calculated on the portal, which can be paid as per directions therein.

After submision of all the documents and payment of stamp duty, necessary action will be taken by the concerned office of the verified by the Sub Registrar for registration of the document.

IMPORTANCE OF STAMP DUTY AND REGISTRATION CHARGES

-

Transfer of Ownership: For Ownership Transfer of a property, the applicable stamp duty has to be paid and sale deed is mandatorily required to be registered. The legal title of the buyer over the property gets established by Registration and saves the buyer from any claims or disputes by third parties. In the absence of registration, the ownership of the property can be challenged any time, which may result in legal complications.

-

Make Documents Legally Valid: The documents, wherein rights and obligations of the seller and the buyer are clearly defined, become legally enforceable instruments recognised by .

-

Affect Purchasing decisions: The overall cost of the property for a buyer increases affecting affordability and purchasing

-

Source of Revenue for the State: Stamp duty and registration charges generate revenue for the state governments. Such a revenue is utilised for public welfare schemes and various infrastructure projects for development and plays a big role in the economic growth.

-

Transparency: The payment of stamp duty and registration charges is made on the actual value of the transaction, which helps in preventing any tax evasion and curbs black money in the system. This transparency leads to creating a stable real estate market, which helps in fostering confidence and trust in public.

-

Protection of Consumers: The payment of Stamp duty and registration charges helps the buyers in verifying the authenticity as also ascertaining the legal status of the property with the result that risk of any fraud is minimized. Buyers get assured the property in question has a clear and marketable title.

CONCLUSION

As can be appreciated from above, payment of stamp duty and registration charges is not only a legal requirement but also a significant step in establishing the legal ownership of a property. Moreover, such property is safeguarded against any future legal dispute.

NOIDA, being a city in Uttar Pradesh (U.P.), it is governed by Stamp Duty and Registration Charges fixed by the Government of U.P., as shown above. While Registration charges are 1% of the value of property in the case of both a Man and a Woman, a relief of Rs.10,000/- on stamp duty has been given, where property is transferred to a Woman. Similarly, a relief has been provided in the case of a Gift Deed to any of the Blood relatives, as prescribed. Here, a stamp duty of Rs.5000/- only is required to be paid.

You have mentioned very interesting details! ps decent site.Blog money